Growing Your Loan Portfolio in an Uncertain Rate Environment

Live Webinar: July 23rd | 2 PM EST

Join us for an insightful webinar designed specifically for credit union leaders. Uncertainty around loan rates continues to create a dynamic lending environment but the competition for loan opportunities is beginning to heat up. The majority of consumers would prefer to take out a loan with their primary credit union, but the importance of low rates is ultimately too great. Don’t let your members slip away during this uncertain rate environment. Prepare to capitalize on the over 60% of consumers who are willing to refinance their current debt if offered a favorable rate, according to Kantar/Mintel.

In this session, experts from Vericast will share relevant industry insights and proven strategies credit unions are using to win and defend loan opportunities. This webinar is a must-attend for credit union leaders looking to stay ahead of the competition and drive loan growth. Don’t miss out on these valuable insights!

Key Takeaways/ What You’ll Learn:

- Current industry insights and trends

- Learn actionable techniques to attract and retain loan customers in a competitive market.

- Discover how to create tailored loan offers that resonate with your members and drive higher engagement.

- Understand how to monitor all three major credit bureaus and respond within one business day when your customers apply for loans elsewhere.

Register Your Spot

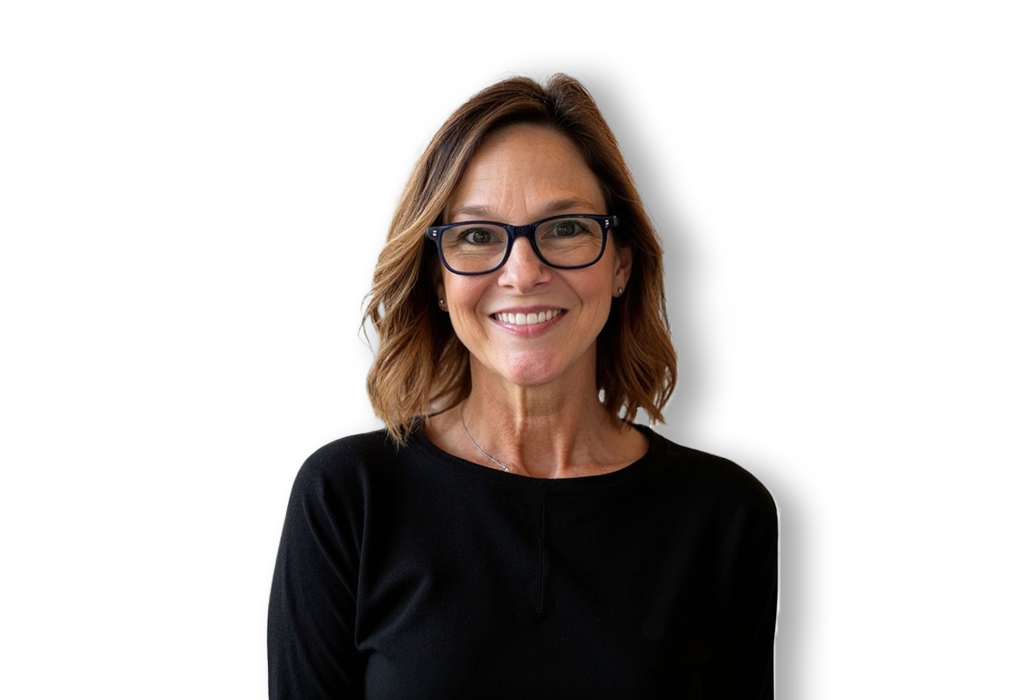

Guest Speaker:

Kimberly Gaines

Business Analyst, Financial Services

Kim Gaines has over 30 years of experience in the financial industry as a marketing professional. As a business analyst at Vericast, she focuses on lending acquisition and develops strategies that incorporate best practices across lending solutions to achieve strong results for her clients.